The Roman Report

March 2023

Quarterly Update

We have exciting updates to share as we continue to move forward into 2023. Our focus remains to acquire mid-market buildings in Southern California, with a particular focus on Orange County and San Diego to diversify our investments and avoid the ULA tax prevalent in Los Angeles.

Following our analysis of our portfolio at the end of 2022, we’re in good shape with stable buildings, high occupancy rates, and good-paying tenants. Our debt is well-managed, with most not expiring for the next few years. We’re also pursuing evictions for tenants who haven’t paid rent during the eviction moratorium, which will increase the value of our assets.

In addition, we are actively collaborating with our CPA to prepare tax returns for our investors. Once the returns are ready, we will promptly notify you via email and upload them to your AppFolio investor portal for easy access.

Recent Projects

We’re thrilled to announce that we successfully closed our latest investment, an 8-unit development project on Craner Ave in Los Angeles. The existing property has been demolished, and we’re excited about the potential of this project (more info in below section “Property Roundup”).

Additionally, we’re working on our largest acquisition to date, a 138-unit multifamily development project in North Hollywood. We purchased the land from a motivated seller at an incredible price of $63,000 per unit. The project is fully permitted and will be shovel-ready by Q4 of 2023. This acquisition will cost approximately $50 million, including $35 million in construction debt. We’re partnering with two General Partners who we’ve worked with in the past, and we’re confident that they’ll bring tremendous value to the project.

Economic Outlook 2023

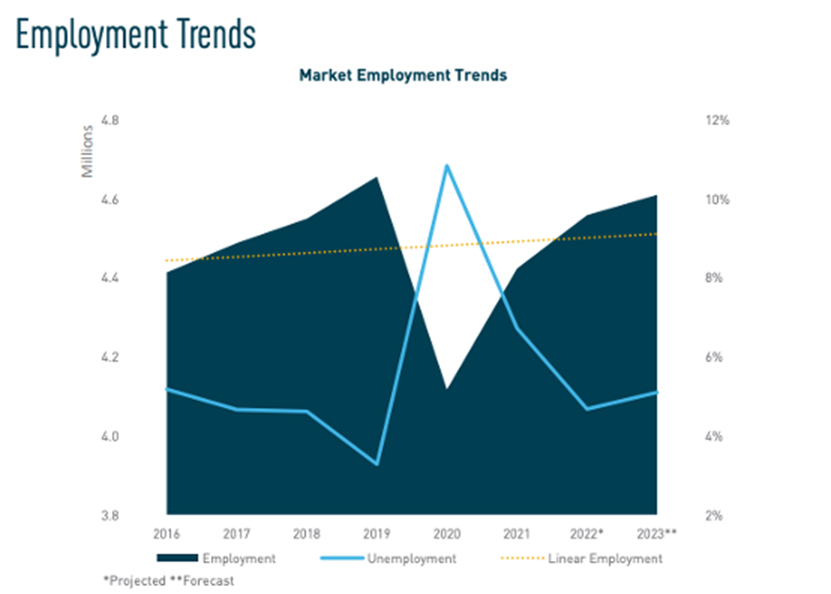

According to the Los Angeles County Economic Development Forecast, the economic outlook for 2023 is somewhat positive, with real GDP growth, personal income growth, and employment growth expected to rise. Although there’s been a slight decline in population in LA County, the demand for apartment units is increasing due to the housing crisis. Only 13% of households can afford a median priced single-family home, which benefits our focus on multifamily and coliving investments.

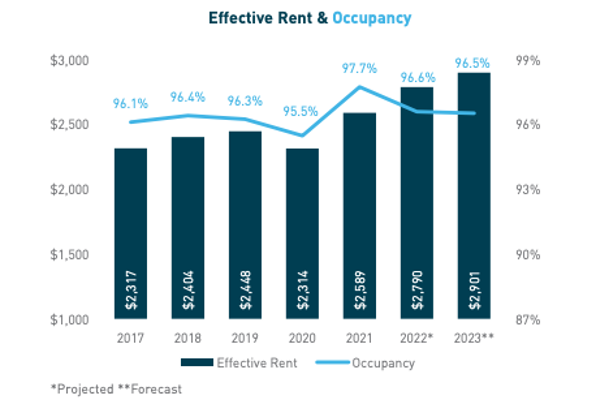

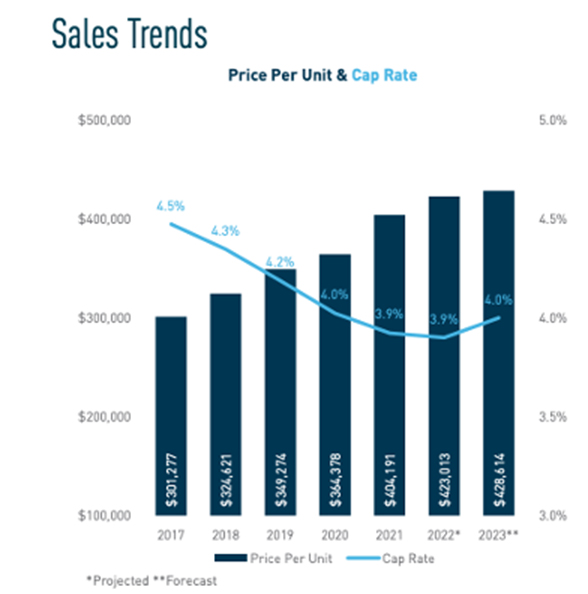

Berkadia’s research study projects job growth and an influx of new apartments, generating robust demand in 2023 for both Los Angeles and Orange County. In LA, effective rent is expected to increase by 4% to $2,901, while occupancy rates remain above 96%.

Property Round Up

We are excited to share the news that the investment on 6028 Craner Ave has been successfully closed. If you are a first-time investor with Roman Group, an investor portal will be created for you through AppFolio, where all updates related to the investment, including tax returns and distribution reports, will be provided.

Useful Articles

Hackman Plans $1B Expansion of Los Angeles Studio

Hackman Capital Partners continues to expand its bulging portfolio in the red-hot film and TV production sector, now worth more than $8B.

Beyond Population Shifts: Why Multifamily’s Outlook Is Good

After historical performance, it’s tough to top yourself. Multifamily has faced that challenge, according to Marcus & Millichap’s 2023…

LAEDC’S 2023 Economic Forecast Recap

The Los Angeles County Economic Development Corporation (LAEDC) is proud to harness our convening power and research insight as a catalyst for economic growth with the release of…

Pasadena Moves to Eliminate Planned Development Zoning

The City of Pasadena moved on Monday to eliminate its planned development zoning designation, effectively nixing an avenue that was designed to expedite major project approvals in the affluent city.